Underwriters the Non-Cumulation Clause was designed to thwart a policyholder that was. A claim will only be paid out on an asset based on the insurable interest that the policy.

Using Terms Conditions To Limit Liability Termsfeed

Provision in many property insurance policies that spreads the obligation to pay a claim among various insurers covering that claim in proportion to the insurance each has written on the property.

. A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk. Therefore it is responsible for 13 of the 24000 loss or 8000. Pro rata clauses keep claims payouts fair in cases where multiple insurers cover the same asset.

After the insurer covers that percentage the other companies pay for the rest. Pro rata liability clause. Pro-rata shares of an LLC are based upon the amount of capital contributed to the LLC since members often contribute varying amounts.

For example there are three different policies covering a. A pro rata clause in an automobile insurance policy provides that when an insured person has other insurance policies covering the same type of risk the company issuing the policy with the pro rata clause will be liable only for a proportion of the loss represented by the ratio between its policy limit and the total limits of all the available insurance. Pro rata condition of average relates to the proportion of an asset that an insurance policy covers.

The pro rata liability clause is designed to protect the principle of The two major actions required for a policyholder to comply with the Reinstatement Clause are Life insurance policies will normally pay for losses arising from. Sometimes members must make additional contributions of capital during the operation of the LLC. Asset protection planning is like a wolf hunting a skunk-The wolf knows it can kill the skunk-but at what price.

Each policy is written for 100000 and each has the pro rata liability other insurance clause. 16 Christopher French. Underwriters the Non-Cumulation Clause was designed.

For example you might prorate monthly rent payments if you only rent an apartment for part of the month or have your biweekly salary prorated if you start or leave your job in the middle of a pay period. These contributions may increase the voting or financial rights of the member who is making these additional. Pro Rata Liability means the applicable Shareholder or Partner s Allocable Portion multiplied by the amount of damages or liability caused by such claim or series of related claims and calculated separately for each such claim or series of related claims causing such damage or liability.

Continue to protect the Assured for liability in respect of such personal injury or property damage without payment of additional premium. Clause to eliminate mandatory distribution. Pro Rata Rate daily premium X days.

The clause typically. LESSEES pro rata share shall be the product obtained by multiplying the total of such expenses by a fraction the numerator of which shall be the square feet of Net. Looking for information on Pro Rata Distribution Clause.

Two pro-rata clauses are enforceable and each carrier responds in accordance with its share. Pro rata clauses spread liability and prevent insurance overpayments. In addition to the rent and other sums to be paid hereunder by LESSEE LESSEE shall pay a pro rata share of the following expenses of LESSOR related to Building II andor the common areas of BRANDYWINE CENTRE II.

The key may be to a successful Asset Protection Limited Liability Company can be summarized by 15 key provisions which create an environment distasteful to a plaintiff seeking your assets. A pro rata clause is a clause in an insurance policy which states that each insurer providing coverage for an asset will pay out claims for that asset in proportion to the coverage percentage for the asset that it is providing. The pro rata liability clause is designed to protect the principle of.

Based on 1 documents. Clause is designed to confer that honor on the other company1. The pro rata liability clause is designed to protect the principle of Indemnity If more then one policy is in force on the same property at the same time covering the same perils this is concurrent coverage.

All groups and messages. Each policy will pay 25000 for the loss. Pro rata liability applies.

Pro rata allocation. Each policy pays a percentage of the loss based on the percentage of coverage that policy provides. Company A carries 13 of the total coverage 20k 40k 60k.

Pro-Rata The pro-rata clause provides that the insurance carrier will not be liable for more than its pro-rata share of the loss. Finally when faced with excess and pro-rata clauses the excess trumps the pro-rata and the pro-rata policy must be exhausted first. Competing excess clause are mutually repugnant and therefore disregard.

Pro-rata refers to parceling something out proportionally. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Pro Rata Rate 1000annual premium365 x 76 two and a half months Pro Rata Rate 208 approximately.

Another situation in which these pro rata rates help insurance companies to carefully calculate the exact premium required for a policy is when the policy. The pro rata rate in this case would be. Liability when other insurance protection is available.

In the event of a total loss to the building what would each insurer pay. Click to go to the 1 insurance dictionary on the web. Pro rata allocation - divides the liability amount equally among the policy years triggered.

Continue to protect the Assured for liability in.

Common Term Sheet Pitfalls Toptal

Chapter 6 Analysis Of Insurance Contracts Ppt Download

Fundamental Principles In Insurance Ppt Video Online Download

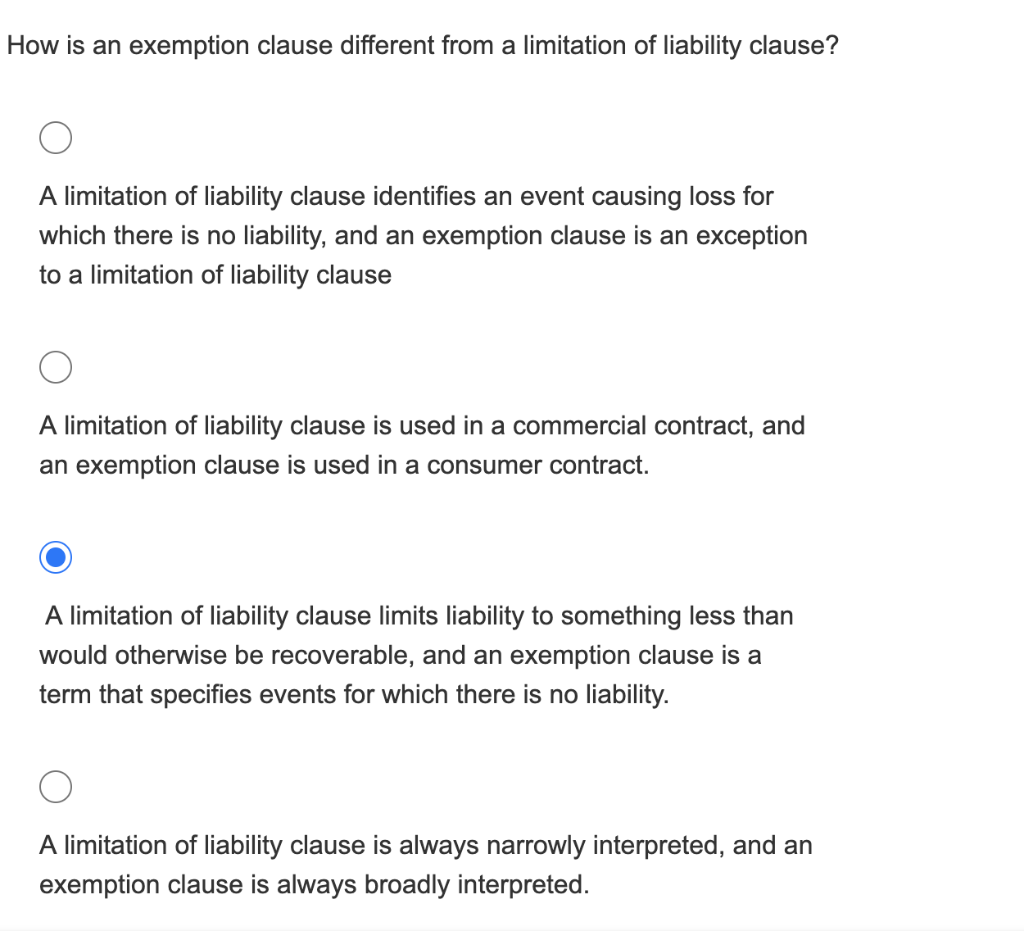

Solved How Is An Exemption Clause Different From A Chegg Com

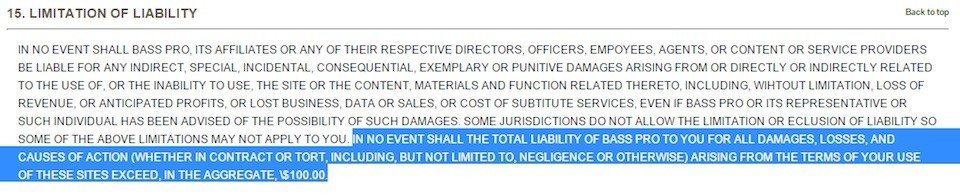

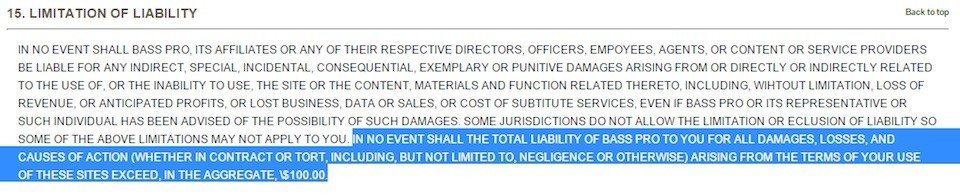

Draft Limitation Or Exclusion Of Liability Clauses Termsfeed

Definition Of Pro Rata Clause In Insurance

Chapter 6 Analysis Of Insurance Contracts A Genda Basic Parts Of An Insurance Contract Deductibles Other Insurance Provisions Ppt Download

0 komentar

Posting Komentar